The modern SaaS buying journey is a masterclass in self-service and internal debate. Buyers, armed with information, orchestrate complex evaluations, often delaying direct vendor engagement until late in the process. Meanwhile, sales teams, under pressure to close deals, crave immediate buying signals, often dismissing leads that lack clear context or immediate urgency. This creates a disconnect: what buyers are doing versus what sellers are prepared to act upon. This post explores that friction.

The Buyer’s Perspective: A Multi-Stage, High-Stakes Game

Modern SaaS purchases are rarely solo decisions. Buyers assemble committees, gather internal consensus, and meticulously assess risk. The early stages are characterized by research: problem definition, solution exploration, and vendor discovery. This phase is often conducted in the shadows – website visits, content consumption, and competitive analysis. These are vital signals, but they lack the immediate “ready to buy” context sales teams crave. The buyer is building a case, not issuing a purchase order.

The vendor evaluation stage is where things truly intensify. Buyers are not just comparing features; they’re assessing organizational fit, implementation complexity, and long-term value. This involves deeper dives into product documentation, perhaps a free trial, and internal stakeholder presentations. When a sales rep reaches out at this stage without understanding these internal dynamics, they risk being seen as irrelevant or, worse, a disruption.

The Seller’s Dilemma: Volume vs. Velocity

Sales teams operate under relentless pressure. They are judged on quota attainment, deal velocity, and the efficiency of their time. Any lead that doesn’t immediately demonstrate a pressing need and a clear path to closure is often deprioritized. This is not necessarily a flaw in the system; it’s a consequence of resource allocation. Sales professionals need to focus their efforts on opportunities that are most likely to yield results.

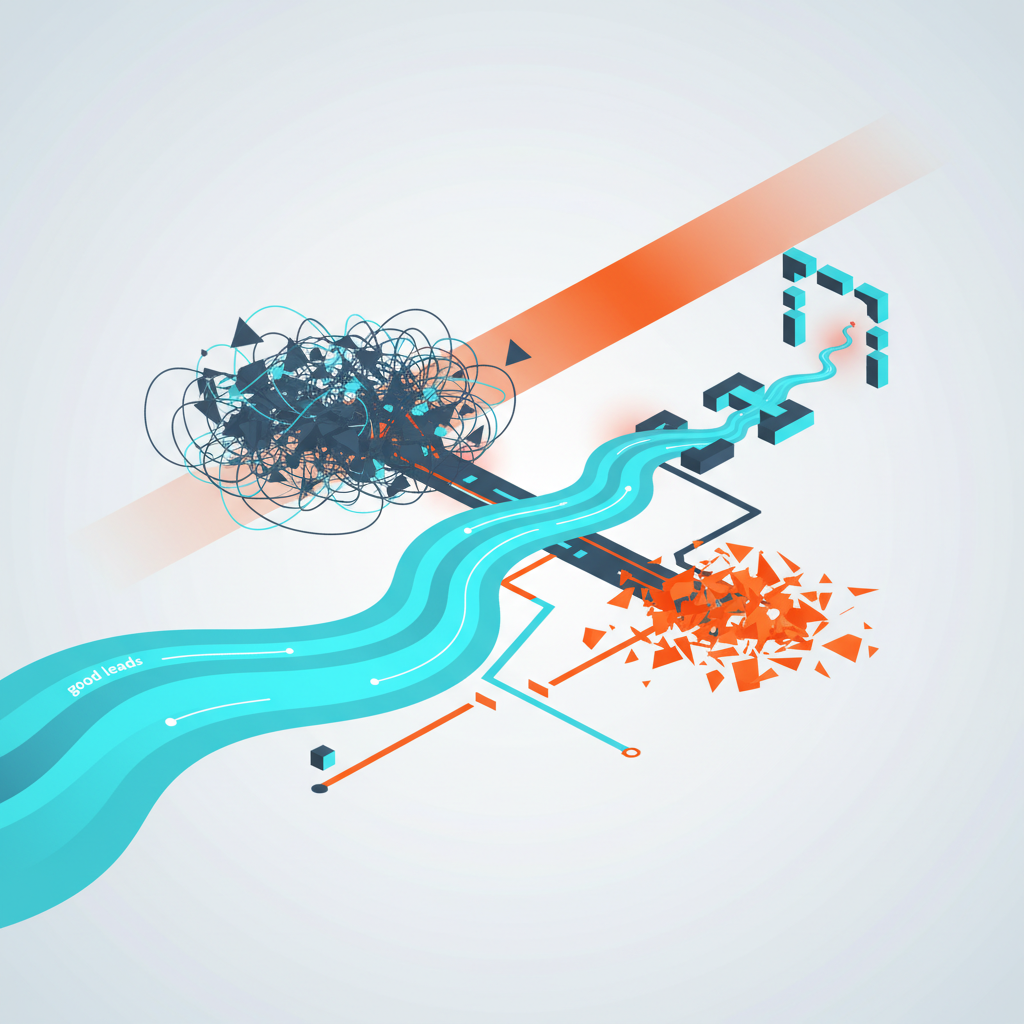

The problem arises when sales teams are trained to distrust anything that doesn’t fit a specific profile. Leads that appear “good” based on traditional metrics like job title or company size are often ignored because the story is incomplete. They lack the context needed to justify the time investment. The salesperson doesn’t know the internal dynamics, the specific pain points, or the internal champions, and so the lead is often left untouched.

The Missing Piece: Contextual Intelligence

The fundamental disconnect is a lack of contextual intelligence. Sales needs to understand the buyer’s internal world – their problem, their goals, and their evaluation process. This is where demand generation should excel. It’s not just about generating leads; it’s about providing the insights that allow sales to engage at the right moment, with the right message, and with the right understanding of the buyer’s internal landscape.

This means going beyond simple lead scoring. It means analyzing buyer behavior, mapping content consumption to the buying journey, and identifying the internal stakeholders involved. It means recognizing that a “good” lead might not be ready to talk today, but that doesn’t mean it’s not a valuable opportunity. That lead might be actively researching and building internal consensus. The key is to know when to engage — and when to let the buyer continue their internal process.

The Value of Patience, Precision, and Preparation

The irony is that sales often ignores the very leads that represent the most promising long-term opportunities. By focusing on immediate gratification, they miss the chance to influence the internal evaluation process and become the vendor of choice. The solution is not more volume; it’s more insight. It’s about helping sales understand the buyer’s world so they can engage with precision and relevance — and ultimately, win more deals.